Have questions about the machining market report? Interested in a sample? Questions about pricing? Need to pay a different way? Get in Touch

At $28.6 billion, the metal machining market is still in recovery compared to pre-pandemic levels. Our report provides an in-depth analysis of the machining market across aerostructures, landing gear, engines and other systems. The report also includes market sizes and forecasts for the $2.6 billion AFP/ATL market. Through our analysis of the market, we estimate the number and value of machine tools purchased in 2023. The report includes commentary on technology trends in machining, machine usage by various manufacturers, and the current state of additive manufacturing.

Report Highlights

- Market size of the metal machining market

- Market size of the automated tape laying / automated fibre placement market

- 10-year forecast for the machining markets

- Segment level forecasts for:

- Aerostructures

- Landing gear

- Engine components

- Systems and equipment

- Market shares for producers of machined components

- Geographic breakdown of machining

- Market insight into recent private equity and consolidation activity in the machining market

- Technology trends in metal machining and automated composite structures

- Profiles of over 19 machine tool providers including Fives, M Torres, Trumpf and Electroimpact

What’s included

- 104-page report document (PDF format)

- Customer data package (Excel format)

- 1-hour phone call with the Counterpoint team (for Team and Enterprise licence holders)

Table of Contents

- Summary

- Scope of report

- Methodology

- Glossary and abbreviations

- Overview of machine tools

- Types of machine tools

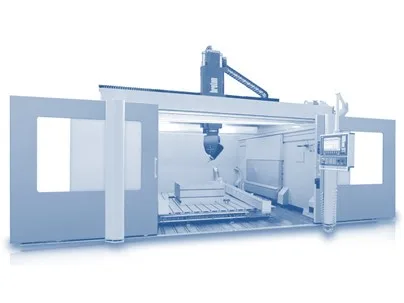

- 3/4/5-axis CNC machine tools

- AFP/ATL machines

- EDM

- Grinding

- Jig Boring

- Business model of machine tool companies

- Types of machine tools

- The metal machining market

- Aerostructures

- Engine components

- Landing gear structure

- Systems and equipment

- The machine tool market – metal machining

- Market overview

- Price trends for machine tools

- Profiles of metal machine tool suppliers

- The automated composite structures market

- Market overview

- Profiles of ATL and AFP machine suppliers

- Machine usage by manufacturer

- Trends influencing the machine tool segment in aerospace

- Global aerospace growth trends

Key Tables and Figures

- Aerostructure metal machining market forecast

- Aerostructure metal machining direct versus outsourced market size

- OEM market shares for aerostructure metal machining

- Supplier market shares for aerostructure metal machining

- Geographic split for aerostructure metal machining

- AFP/ATL market forecast

- AFP/ATL market size by aircraft role

- Market shares for AFP/ATL

- Engine machining market forecast

- Engine machining market size for direct versus outsourced

- Market shares for engine machining

- Geographic split for engine machining

- Landing gear machining forecast

- Landing gear machining market direct versus outsourced

- Market shares for landing gear machining

- Systems and equipment machining forecast

- Systems and equipment machining market direct versus outsourced

- Market shares for systems and equipment machining

- Total metal machining forecast

- Total metal machining direct versus outsourced

- 3/4/5 axis CNC units by application

- Machine tool demand

- Additive manufacturing replacement threat for various applications

Interested in a sample?

Please contact us by the form below: