Note: this page describes our 2023 report; our 2024 Aerostructures report is now available

The aerostructures supply chain is continuing to evolve and the pandemic has served to accelerate change and highlight vulnerabilities. In addition, the world is now subject to much greater political risks, all of which are prompting change. This will include the aircraft OEMs’ changing aerostructures sourcing strategies, and continuing challenges around supply chain resilience, with the longer-term uncertainty around possible new propulsion systems and aircraft configurations.

We have been analysing the market for a long time, both in the manufacturing sector and now, over the last 19 years, as analysts. For these reasons we believe that we are well placed to describe the current landscape, identify trends, and advise on emerging threats and opportunities.

Our 2023 report also offers comprehensive market analysis including:

- Overall market size, growth and market shares in 2022:

- The estimated segmentation of this $48 billion market (up from $42 billion in 2021), including:

- Composite, titanium and other metallic structures

- Civil and military: OE production, spares and modifications

- Generic aircraft type: e.g., large commercial, regional, business, helicopters

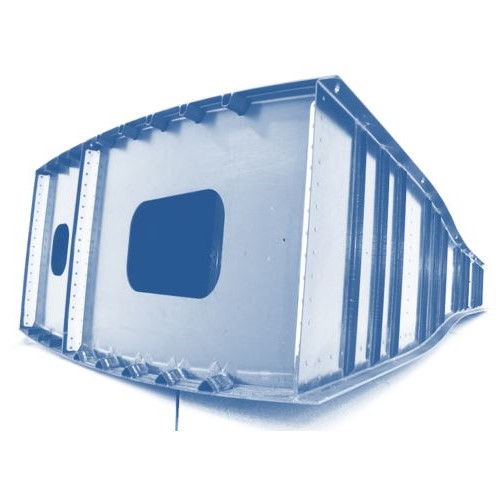

- Aerostructures product type: wings, fuselage, nacelles & pylons, empennage

- Market tier: super tier-1, tier-1, tier-2; the value of sales at different points in the supply chain

- 10-year segmented market forecasts

- Market shares by the segments described above

- The estimated segmentation of this $48 billion market (up from $42 billion in 2021), including:

- Composite aerostructures market analysis:

- Market size, segmentation and growth forecast

- Market shares

- Technology

- New developments in composites and metals technology including:

- Thermoplastics

- Composites recycling

- Additive manufacturing

- Automation and industry 4.0

- Government and state-funded R&T programmes

- New developments in composites and metals technology including:

- Market trends and key characteristics

- Financial performance, including reported aerostructures profitability, and analysis

- Industry consolidation, including analysis of M&A activity.

- Competitive background by segment and sub segment

- The move to more insourcing by the aircraft OEMs and large tier-1s

- The continuing role of Low Cost Countries

- The evolving role of China

The report provides profiles of 193 companies. Our profiles cover:

- Origins and ownership; Our estimate of aerostructures sales, plus financials if obtainable; operations and technologies; customers and contracts; strategy and recent developments; our comments including our categorisation of composites capability

We offer purchasers of our report a free teleconference to discuss any aspects.